Topics | Yurakucho CPA Office (Ginza, Tokyo, Japan)

The first thing you need to do after you start a business

You started a business in Japan and you know when you need to file a return? OK. There is one more thing you can do. You need to prepare two documents relating your tax and submit them to a tax office.

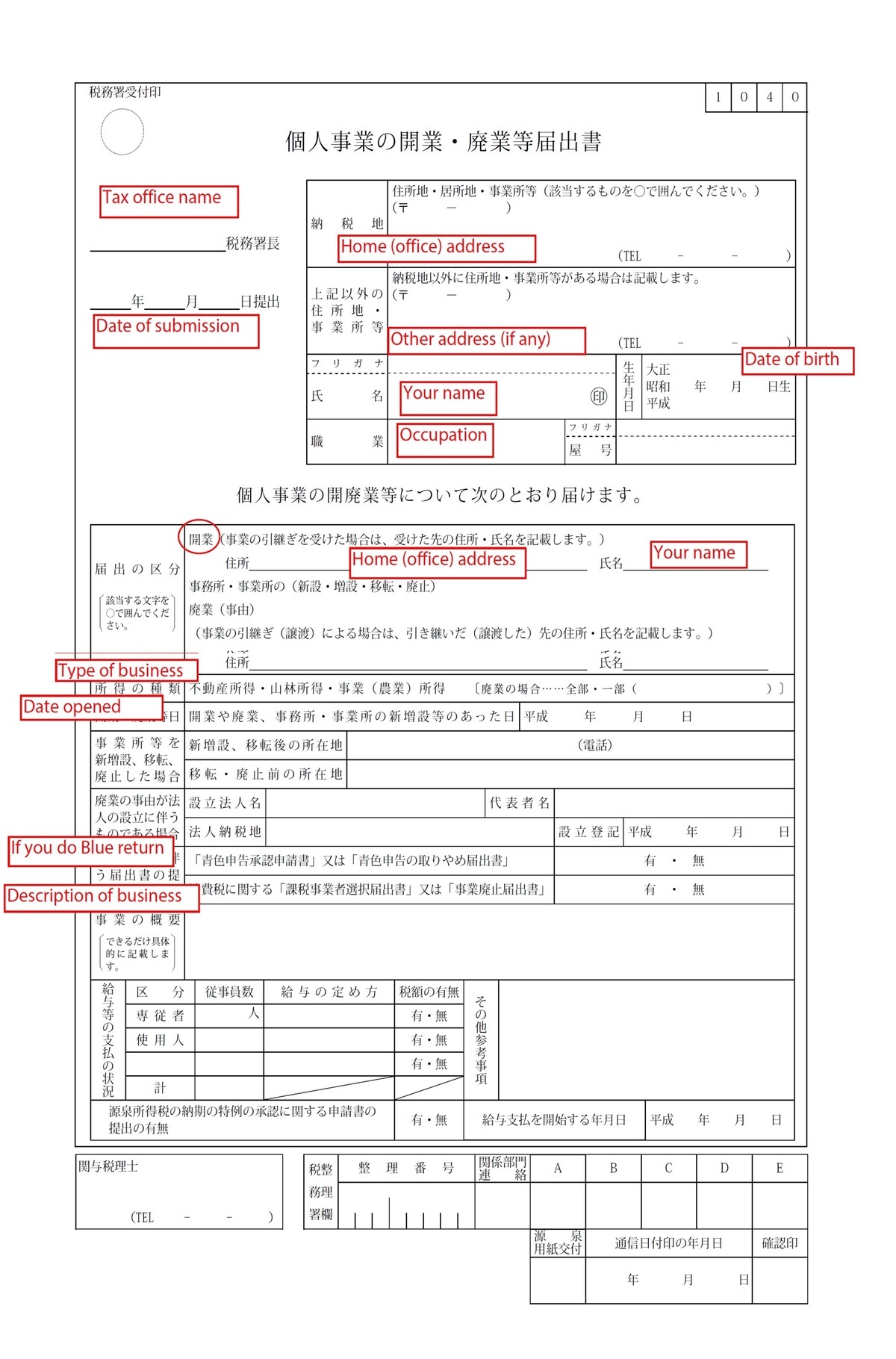

Notification of opening a business

You need to tell a local tax office that you started a business. The notification is called '個人事業の開業・廃業等届出書' in Japanese. What you do is actually very easy. You can just prepare a single document and send it to a local tax office within one month after you started a business. This is the link. It is Japanese only so you can see what is required as follows.

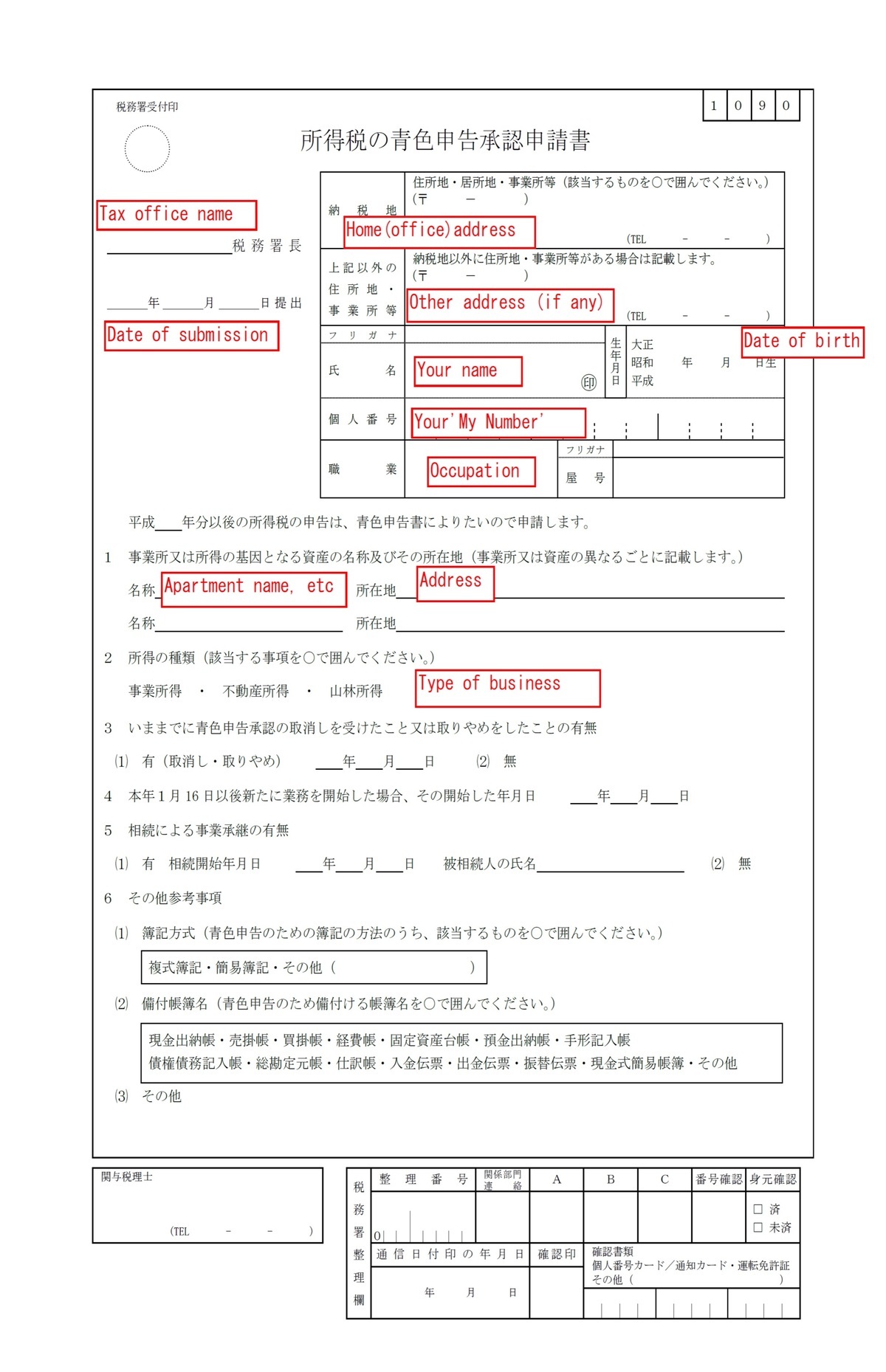

Blue (Aoiro) return form

There is one more document we recommend you prepare. Blue (Aoiro) return form (青色申告承認申請書) will give you a great tax benefit. You may get JPY 650,000 as additional expense (lower your taxes) without any payment. This form needs to be prepared and submitted to a tax office within two months after you started a business. Here is the link, and below is a brief instruction.

If you have any questions about these documents, feel free to ask us.